How to Buy a Home With Little or No Money Down

Pasadena is looking to add a 3/4 percent sales tax to the ballot to avoid a looming deficit.

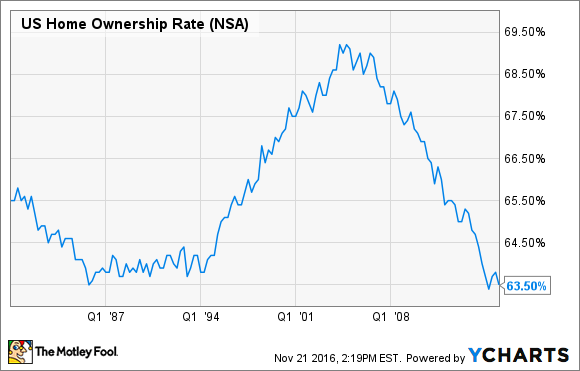

Homeownership in the United States has fallen to a generational low, and a big reason for this is a lack of first-time homebuyers. In a recent survey by Trulia, 54% of renters cited “saving enough for a down payment” as their biggest obstacle to homeownership, more than credit requirements and other debt obligations. However, the idea that a big down payment is a requirement is a myth. Here are some options you should explore if you want to buy a home, but don’t have a ton of cash.

Conventional loans with as little as 3% down

Conventional mortgages — that is, those not guaranteed by the government and that conform to Fannie Mae or Freddie Mac’s lending standards — were quite difficult to get in the wake of the financial crisis. This was especially true if you didn’t have 20% of the home’s purchase price to put down.

Fortunately, it’s gotten easier again in recent years. Conventional mortgages are now available with down payments as low as 3% thanks to programs from Fannie Mae and Freddie Mac. You’ll probably have to pay private mortgage insurance (PMI) until your loan-to-value ratio drops below 80%, but this is a good option for borrowers who qualify.

To qualify for a loan with 3% down, you’ll need a credit score of at least 660, plus six months’ worth of mortgage payments in reserve. In addition, your total monthly debt payments — including your new mortgage payment — cannot be greater than 36% of your gross income. With a higher credit score, the reserve requirements can be relaxed and the debt-to-income maximum could be as high as 45%.

FHA loans: Pricier, but good for poorer-credit buyers

If your credit isn’t good enough to qualify for a conventional loan, a FHA mortgage may be an option. The down payment requirements are as low as 3.5%, and the funds can come from the seller or a gift.

Credit requirements for a FHA loan are relatively low. You can get a 3.5% down loan with a FICO score as low as 580, and you can get financing with an even lower score if you have 10% to put down.

The downside is the cost. FHA mortgage insurance premiums for a 30-year loan with 3.5% down are 0.85% of the outstanding balance per year, which is competitive with the PMI you would pay on a conventional loan, but there are two big caveats. First, while you can drop PMI after you pay down 20% of the home, your FHA mortgage insurance payments generally continue for the life of the loan. Second, you’ll also pay an upfront mortgage premium equal to 1.75% of the loan amount.

VA and USDA: 100% financing for those who qualify

Veterans Administration loans are available to active-duty or retired military personnel who meet certain service requirements. Reservists can also qualify after serving for six years. If you qualify, a VA loan requires no down payment whatsoever, nor does it require mortgage insurance, so it’s usually a smart choice for those who can take advantage of it.

U.S. Department of Agriculture loans are another 0%-down financing option, available to low- to middle-income homebuyers in areas that are defined by the USDA as “rural.” There technically isn’t any mortgage insurance needed with a USDA loan; however, you will have to pay an upfront and recurring “guarantee fee.” Check the USDA’s website for specifics and to determine whether a particular home would qualify.

Individual banks offer other options

In addition to the loan products I’ve already discussed, several banks have their own loans designed for aspiring homebuyers without a lot of cash to put down. For example, Regions Financial (NYSE: RF) offers its “Affordable 100” loan program, which provides 100% financing and with no mortgage insurance to borrowers with excellent credit.

I found out about the Regions program because someone used it to buy the last house I sold — so these lender-specific programs do exist, and are being qualified for by actual, everyday homebuyers, not just an elite few. BB&T (NYSE: BBT) is another lender that offers a similar program with 97% financing to low- and moderate-income borrowers. I’m sure there are others, so it could be worth the time to check with your local and regional banks to see what unique programs they might offer.