How I’ve Discreetly Sold Hundreds of Properties in Probate Proceedings

Ambulance Chaser. Opportunist. Vulture.

You name it, I’ve been called it, and understandably so. When you lose a loved one, getting your finances in order is usually the last thing you’d want to discuss while you are grieving.

Yet as sensitive as this chapter is, grieving families often encounter additional stress while trying to navigate the complex legal, financial, and administrative aspects of probate administration. Depending upon the specific circumstances, the probate process can be relatively simple, or lengthy and costly for heirs.

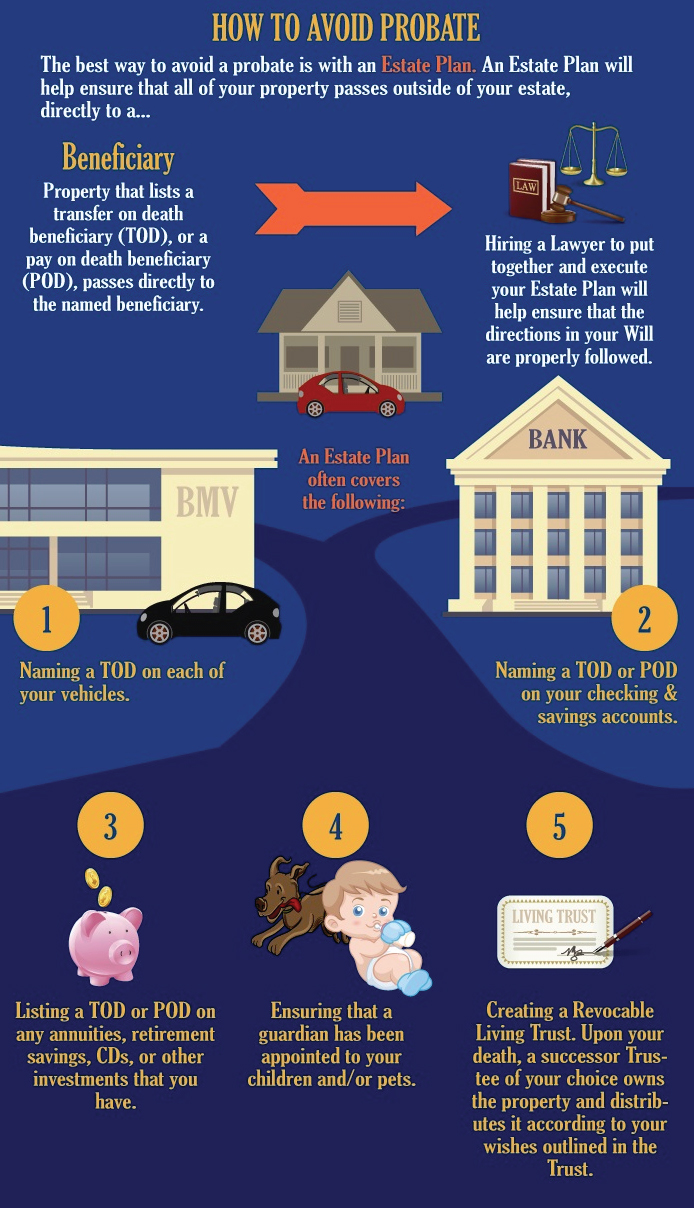

There's only 2 Ways to Avoid Probate

A LIVING TRUST

If the decedent established a living trust prior to passing, and you were designated as the appointed trustee, the trust instrument will provide that court intervention is not required, and you have the right to decide how you would like to hold or disburse the assets included in the trust.

If a living trust is properly written and funded you can:

- Avoid probate on your assets

- Plan for the possibility of your own incapacity

- Control what happens to your property after you are gone

- Use it for any size estate and prevent your financial affairs from becoming a matter of public record

WILL AND LAST TESTAMENT

If the decedent properly executed a will (also known as a last testament), it will specify and/or designate who the executor is and how the estate is to handled, including how and to whom property should be divided. It is important to note however, that the will must be shown to be valid. This is usually done by having witnesses to the will sign a sworn statement that’s submitted to the court.

Your job as the appointed executor will probably last six months to a year. You must file and submit :

- The will and last testament of the decedent

- A document called “Petition for Probate” with the probate court in the county where the deceased person lived

- Formal notices given to interested parties via certified mail and legal publication (an attorney can help you with this.)

When everything is in order, the court issues “Letters Testamentary” or “Letters of Administration,” appointing you as the executor and granting you authority over estate assets.

NO WILL + NO LIVING TRUST = PROBATE

If the decedent passed without executing a living trust, intestate (without a will) or without bequeathing their property, the assets must be sold and distributed through probate court. When that happens, the state takes over and administers the property’s sale with the assistance of a court-appointed administrator who may receive full or partial authority based on the judge’s discretion and court orders.

If wish to act as the administrator of the decedent’s estate, it is recommended that you hire an attorney to assist you with in filing the proper paperwork to petition for the court to grant you either full or partial authority.

“Paul is motivated and demonstrates a high level of commitment to getting the job done. His staff works together to make sure that all aspects of the real estate sale are accomplished timely and effectively. He is available and responsive. Paul and I worked together recently regarding a rather complex [probate] real estate transaction. I found Paul to be knowledgeable and deliberate in his ability to navigate a potentially difficult situation. He and his staff have what it takes to bring even a difficult sale to a successful close.”

Solomon A. Cheifer, Esq

Call (855) 654-7285 to schedule a confidential discussion about your property today!

The consultation is free, and there is no obligation.

Your 4 Duties as the Executor or Administrator of the Estate

DUTY #1

FILE A PETITION AND GIVE NOTICE TO HEIRS AND BENEFICIARIES

As described above, the probate process begins with the filing of the petition with the probate court to either

- Admit the will to probate and appoint the executor.

- Appoint an administrator of the estate if there is no will.

Generally, notice of the court hearing regarding the petition must be provided to all of the decedent’s heirs and beneficiaries. If an heir or beneficiary objects to the petition, they have the opportunity to do so in court. Also, generally, notice of the hearing is published in a local newspaper. This is to attempt to notify others, such as unknown creditors of the decedent, of the beginning of the proceeding.

DUTY #2

GIVE NOTICE TO ALL KNOWN CREDITORS

Following appointment by the court, the personal representative must give notice to all known creditors of the estate and take an inventory of the estate property.

The personal representative then gives written notice to all creditors of the estate based upon state law; any creditor who wishes to make a claim on assets of the estate must do so within a limited period of time (which also varies by state).

An inventory of all of decedent’s probate property, including real property, stocks, bonds, business interests, among other assets, is taken. In some states, a court appointed appraiser values the assets. When necessary, an independent appraiser is hired by the estate to appraise non-cash assets.

The court wants to be certain the property is marketed and sold at the best possible price. I have completed thousands of Broker Price Opinions (BPO’s) that have been used to ensure accurate pricing of the home in probate court. The court will also appoint a court referee to complete a drive by appraisal of the property as well.

DUTY #3

PAY ALL EXPENSES FROM THE ESTATE

All estate and funeral expenses, debts and taxes must be paid from the estate. The personal representative must determine which creditor’s claims are legitimate and pay those and other final bills from the estate. In some instances, the personal representative is permitted to sell estate assets to satisfy the decedent’s obligations.

DUTY #4

TRANSFER LEGAL TITLE

Legal title in property is transferred according to the will or under the laws of intestacy (if the decedent did not have a will). Following the waiting period to allow creditors to file claims against the estate, and all approved claims and bills are paid, generally, the personal representative petitions the court for the authority to transfer the remaining assets to beneficiaries as directed in the decedent’s last will and testament or, if there is no will, according to state intestate succession laws. If the will calls for the creation of a trust for the benefit of a minor, spouse or incapacitated family member, money is then transferred to the trustee. Unless the beneficiaries of the estate waive the requirement as allowed under some state laws, the petition may include an accounting of how the assets were managed during the probate process. Once the petition is granted, the personal representative may draw up new deeds for property, transfer stock, liquidate assets and transfer property to the appropriate recipients.

DUTY #5

LIST & SELL REAL ESTATE

Any real estate may be listed and sold once all the court requirements have been met. Marketing a probate home for sale is not very different than any other type of sale.

All offers are subject to the court’s confirmation, unless the Administrator of the estate has full authority, and even then, the Administrator should not accept an offer that is 20% less than the appraised value provided the court referee without providing written notice to any other heirs via certified mail. This gives the heirs the opportunity to contest a sales price that may be deemed to low. An attorney will help you do this.